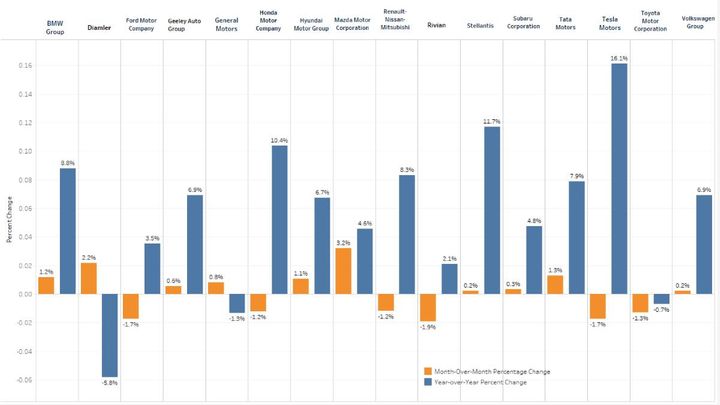

Slight price dips are arising among some automakers, but total brand-new lorry prices are still above sticker label and also above last year.Graphic: Kelley Blue Book The average price spent for a new vehicle in the U.S. in September 2022 was below August’s record however stays sturdily over the$48,000 mark, according to new information launched Oct. 12 by Kelley Blue Book.The Kelley Blue Book new-vehicle average transaction rate (ATP)reduced to$48,094 in September, a little less than the previous high of $48,240. September costs dipped 0.3% ($146) month over month from August, however were up 6.1% ($2,775) year over year from September 2021.

According to Kelley Blue Book estimations, September marks a record 16th straight month that new-vehicle ATPs were more than the ordinary manufacturer’s recommended list price (MSRP), additionally called the price tag.

“Interest rates and also typical month-to-month repayments were up in September, which suggests cost worsened,” said Rebecca Rydzewski, research study manager of financial and market understandings for Cox Automotive, in a news release. “With costs still well above MSRP as well as rewards from automakers still low, sales in September continued to have a hard time as consumers weighed their vehicle-buying choices.”

Average Prices for Luxury Cars Decline Slightly from August

Strong high-end vehicle sales have been a primary factor for total raised new-vehicle rates. High-end vehicle share continues to be historically high, raising to 18% of total sales in September from 17.6% in August. The high share of luxury sales is helping to press the general market ATP higher.In September 2022, the typical deluxe customer paid$65,775 for a new vehicle, down $60 from August when deluxe ATPs struck a document high of $65,835. Customers continue to pay greater than MSRP for brand-new deluxe lorries, although prices are trending closer to or below price tag in some high-end segments.Mercedes-Benz and also Jaguar showed the most cost toughness in the luxury market

, transacting between 2%to 4 %over sticker price last month. High-end brand names Audi, Alfa Romeo, Infiniti, Lexus, Porsche and Tesla showed the least cost stamina, marketing 1%or even more below MSRP in September.Average Non-Luxury Car Prices See Significant Drop yet Remain Above Sticker The average price spent for a brand-new non-luxury

automobile in September was $44,215, down$256 month over month. Usually, auto shoppers in the non-luxury segment paid $829 over price tag, a minor reduction from August.Most non-luxury brand names had stable pricing or declines in September. Buick, Mazda and Dodge revealed one of the most cost toughness in the non-luxury market, negotiating in between 2 %to 4%over price tag last month, while Ford, Honda and Toyota revealed the least rate strength, selling 1% or even more listed below MSRP in September.Electric Vehicle Prices Declined in September but Remained Up Compared to One Year Ago The average rate paid for a brand-new electric vehicle(EV )declined in September by$ 1,162, or down 1.8%, compared to August, yet was up by 9.7%compared to a year ago in September 2021. The ordinary new EV rate was$65,291, according to Kelley Blue Book approximates, well over the industry standard and also aligning a lot more with high-end prices versus mainstream prices.Auto Incentives Offered by Manufacturers Remain Historically Low Motivations lowered once again in September 2022 to only 2.1% of the ordinary transaction cost, a document low. One year ago in September 2021, incentives averaged 5.2%of ATP.

Full-size autos as well as luxury automobiles had the greatest incentives in September at

4.4%of ATP. High-performance automobiles, vans, electric lorries as well as luxury full-size SUVs/crossovers had the cheapest incentives, all less than 1% of ATP.Brands with higher supply degrees supplied higher motivations in September. The Stellantis brands generally had higher-than-average stock in September as well as higher-than-average motivations. While still low from a historic viewpoint, Stellantis ‘rewards in September averaged 4.0%of ATP, below 4.4%in August. Initially uploaded on Vehicle Remarketing